More than likely you are here for one of two reasons: A. You are starting out a new bounce house

business or B. You are looking for a better rate on your existing party rental insurance

coverage. Either way; look no further! We have your comprehensive guide to inflatable rental

insurance right here

Inflatable Insurance for Indoor Centers & Party Rentals

Cossio Insurance Agency provides quality, low cost inflatable insurance for bounce

houses, inflatable slides, jumpers & more! Whether you need Party

Equipment Rental Insurance or have an indoor inflatable business,

our staff specializes in finding competitive insurance quotes for your individual risks. Inflatable insurance

programs vary with different companies and there are many companies that are pulling out of the industry...but

not here at the CIA! We represent all of the best programs in the industry and are able to get you insurance

coverage that you would be unable to find elsewhere.

APPLY FOR INFLATABLE INSURANCE

Inflatable Online Applications (Faster)

Inflatable

Rental Application

Broker Application

Indoor Inflatable Application

PDF Applications (slower)

Inflatable Rental PDF

Indoor Inflatable PDF

Our insurance quotes take into consideration your experience in the inflatable industry, your insurance track

record and the units that you own and operate. This way we are able to provide you with affordable, low

cost prices and the proper insurance coverage for your bounce houses & other amusement devices.

Insurance for Inflatables is our specialty; we do more business with inflatable rental companies and indoor centers than any of our other entertainment programs. Don't take

our word for it...see what our

customers are saying.

What all the talk is about

Cossio Insurance Agency is known throughout the entertainment industry as the leading party rental insurance

provider in the nation. Our friendly customer service, knowledge of the industry, online applications &

resources for our customers, makes us stand out from the rest.

FAQ's

Do I need insurance for a bouncy castle?

The short answer here is yes. Although insurance is not a

requirement in all states, bounce house insurance is something you can't afford to be with out.

Why do I need loss runs? I don’t have any losses?

We need to see your loss runs to get a clear picture of your claims history, to verify prior insurance coverage

for underwriting purposes, to look for patterns of frequency or severity of loss which may cause them concern, and

to calculate your loss ratio for underwriting purposes.

"But isn't my word good enough?" We would love to be able to take your word for it. However, unfortunately people

are not always honest. In order to protect ourselves and to be fair to every one we need to see your loss history

in writing. Kind of like you need to show your pay stubs to get a loan or the way that a car insurance company

would check your driving record.

What does Inland Marine cover?

This is coverage for your equipment itself. This policy will cover your equipment against fire, theft or

vandalism, where ever your equipment is (stored, transit, or at a party).

How is the premium calculated for Inland Marine coverage?

The premium will depend on the value of your equipment.

What do I need to get a quote for Inland Marine Coverage?

Completed inventory list, serial numbers and value of all units.

What is an additional Insured?

An individual or entity that is not automatically included as an insured under the policy of another, but for whom

the named insured’s policy provides a certain degree o Pf protection.

A general liability policy only provides defense coverage for the named insured, which means the corporation, LLC,

officers, members, employees or volunteers. If you have sub-contractors coming into your business or activity you

need to request insurance coverage from them with limits of at least $1,000,000 per occurrence and name you as

additional insured. We would recommend that you do this for their general liability, commercial auto and workers

compensation.

When do I need an Endorsement?

An endorsement is typically required to effect additional insured status.

What is Pay for Play?

Pay for play is a phrase used for a variety of situations in which money is charged per a person for the privilege

to (play) in the inflatables. For example if someone sets up an inflatable at a park and charges for each child to

jump in the inflatable that would be consider pay for play. Party Rentals are not considered pay for play. An

example would be renting a bounce house out for a birthday party, even though the people are paying to use the

inflatable, they are not charging each child to jump in the inflatable, so this is not pay for play.

Can we insure Mechanical Bulls that are inside of bars?

It is much harder to find coverage at an

affordable rate for mechanical bulls inside of bars.

At this time, we do not have a market for mechanical bulls used in bars or events with alcohol.

Why is it harder to insure Mechanical Bulls inside of bars?

It is harder to insure mechanical bulls inside of bars because of the risk of liability involved. The fact that

intoxicated persons will be riding the bulls makes the liability risk very high which means that the premium can

get very high as well.

Cossio Insurance works with many insurance companies to make sure that we can get your party rental insurance

coverage at the best price available on the market!

Bounce House Safety

Bounce house safety is the key to keeping your insurance premiums low. More claims = Higher Premiums

for Everyone. By following some basic safety rules and knowing things to look out for, you can keep

yours and everyone else's premiums from increasing.

Biggest causes of inflatable injuries

Lack of trained supervision: One of the biggest cause of claims that we see is lack of

trained supervision. Do you just drop your devices off or do you make sure there will be attendants with every

device? For Indoor Inflatables, do you have enough attendants to properly supervise all of your devices? Having

enough trained attendants will drastically reduce your chance of someone getting hurt on one of your devices.

Attendants should know the maximum number of children allowed in each device, pay attention to what is going on

inside/on the device, make jumpers take off shoes and loose items and pay attention to the weather. Each device

should have an attendant that is trained in safety rules for that device. For example with an inflatable slide

attendants need to make sure children are coming down the slide one at a time and are sliding down on their

butts. In a bounce house the attendant needs to make sure children are not bouncing against walls or on top of

each other. Depending on the size/layout of the inflatable, some devices require multiple attendants.

Bad Weather The threat of bad weather obviously applies more to party rental businesses than

indoor centers. For party rentals, bad weather is another big cause of accidents.. One strong wind gust can send

an inflatable airborne and cause many injuries and sometimes even death. Wind gusts of 20 mph have the ability

to pick up a bounce house and send it flying. It is very important to check the weather everyday and make sure

that devices are properly secured.

Damaged Devices: It is important to check all inflatables before each use for any signs of

damage. Tears, torn panels & netting, cracked vinyl are all things that should take that inflatable device out

of commission.

Inflatable Articles: Our blog has a lot of good information about accidents that can happen &

tips on keeping your bounces houses safe.

Safety Tools

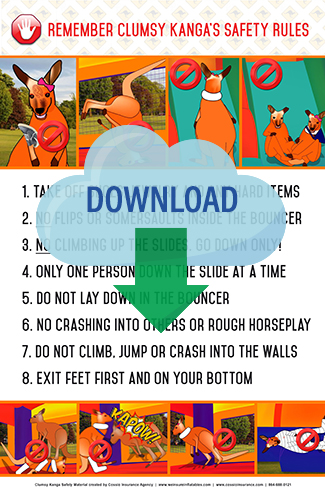

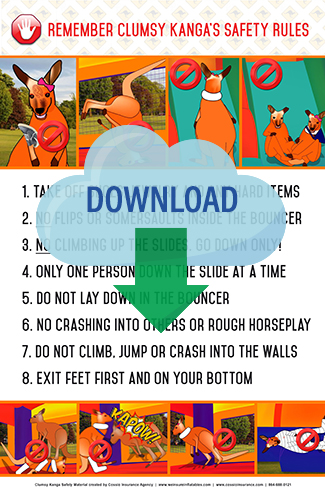

Klumsy Kanga Safety Video: Cossio Insurance Agency developed a short animation that teaches

children bounce house safety. Klumsy Kanga goes through the bounce house safety rules in way that is more fun

and interesting for children. It would be a great idea to show this to all your participants before you allow

them to play on the inflatables. You can download the files using by clicking on the Kanga Poster icon with the

download symbol.

Klumsy Kanga Safety Video: Cossio Insurance Agency developed a short animation that teaches

children bounce house safety. Klumsy Kanga goes through the bounce house safety rules in way that is more fun

and interesting for children. It would be a great idea to show this to all your participants before you allow

them to play on the inflatables. You can download the files using by clicking on the Kanga Poster icon with the

download symbol.

Digital Waivers: Waivers are important for the protection of your business. Although a waiver

is not always assurance against a lawsuit, it is a vital tool in your defense if you were to get sued in the

event of an accident. PALSEG members have access to a free digital waiver program: www.digitalwaiversrus.com . We are unable to give

any advice in terms of the wording of the waiver, this is something that is best done by a lawyer as we are not

experts on the law.

Resources

Ninja Jump, the leader in licensed inflatable products, has

chosen Cossio Insurance Agency to be a Ninja Jump preferred insurance provider for all their customers. We are

pleased to be honored and chosen to provide insurance for their customers.

Ninja Jump, the leader in licensed inflatable products, has

chosen Cossio Insurance Agency to be a Ninja Jump preferred insurance provider for all their customers. We are

pleased to be honored and chosen to provide insurance for their customers.

Visit Ninja Jump's website and see the

licensed inflatables they have to offer!

Amusement Supply Company is your one stop for New & Used Amusements. They Buy, Sell and Trade any

and all

amusement attractions. Items they sell include inflatables, photo booths, Mechanical Bulls, Rockwall & more!

Amusement Supply Company is your one stop for New & Used Amusements. They Buy, Sell and Trade any

and all

amusement attractions. Items they sell include inflatables, photo booths, Mechanical Bulls, Rockwall & more!

Check out their website to see everything

they have to offer.

ClearView Financial finances new or used equipment such as rides, vehicles, trailers & other

equipment for amusement businesses. ClearView is a member of IAAPA & has worked with major manufacturers of

equipment, offering financing in all 50 states.

ClearView Financial finances new or used equipment such as rides, vehicles, trailers & other

equipment for amusement businesses. ClearView is a member of IAAPA & has worked with major manufacturers of

equipment, offering financing in all 50 states.

Check out their

website to learn more about their financing.

InflatableOffice offers rental software to automate your business. Quotes, emails, surveys,

contracts, pay & book online. Integrates w/Google Calendar, Authorize, Quickbooks. Customers of both the CIA &

InflatableOffice can receive a 10% discount on their premium & 10% off an InflatableOffice subscription.

InflatableOffice offers rental software to automate your business. Quotes, emails, surveys,

contracts, pay & book online. Integrates w/Google Calendar, Authorize, Quickbooks. Customers of both the CIA &

InflatableOffice can receive a 10% discount on their premium & 10% off an InflatableOffice subscription.

Check out their website to learn

more about their program.

Amusement Supply Company is your one stop for New & Used Amusements. They Buy, Sell and Trade any

and all

amusement attractions. Items they sell include inflatables, photo booths, Mechanical Bulls, Rockwall & more!

Amusement Supply Company is your one stop for New & Used Amusements. They Buy, Sell and Trade any

and all

amusement attractions. Items they sell include inflatables, photo booths, Mechanical Bulls, Rockwall & more! ClearView Financial finances new or used equipment such as rides, vehicles, trailers & other

equipment for amusement businesses. ClearView is a member of IAAPA & has worked with major manufacturers of

equipment, offering financing in all 50 states.

ClearView Financial finances new or used equipment such as rides, vehicles, trailers & other

equipment for amusement businesses. ClearView is a member of IAAPA & has worked with major manufacturers of

equipment, offering financing in all 50 states. InflatableOffice offers rental software to automate your business. Quotes, emails, surveys,

contracts, pay & book online. Integrates w/Google Calendar, Authorize, Quickbooks. Customers of both the CIA &

InflatableOffice can receive a 10% discount on their premium & 10% off an InflatableOffice subscription.

InflatableOffice offers rental software to automate your business. Quotes, emails, surveys,

contracts, pay & book online. Integrates w/Google Calendar, Authorize, Quickbooks. Customers of both the CIA &

InflatableOffice can receive a 10% discount on their premium & 10% off an InflatableOffice subscription.